Increasing cases of fraud with plastic cards can lead to the fact that customers stop trusting this banking product and refuse to use it. So, what are the main transaction monitoring tools?

What Is Transaction Monitoring and What Tasks Does It Solve?

Fraud with bank cards leads to financial losses and a decrease in customer confidence in this banking product, so it is important to realize the relevance of countermeasures and develop an integrated approach to solving the problem to reduce risks. Early detection of fraud and the adoption of adequate and effective measures are necessary conditions for ensuring the security of the payment system and should be carried out as part of the bank’s operational risk management activities.

A characteristic feature of the modern problem of information security is the complexity of protection. Complexity is understood as the solution within the framework of a single concept of two or more diverse tasks (target complexity) or the use of diverse tools for solving the same problem (instrumental complexity), or both (general complexity).

Transaction monitoring is an effective way to protect funds on the accounts of bank customers from theft. With monitoring, you can:

- check ongoing transactions according to a number of criteria and characteristics;

- timely detect unauthorized use of a bank card and stop it.

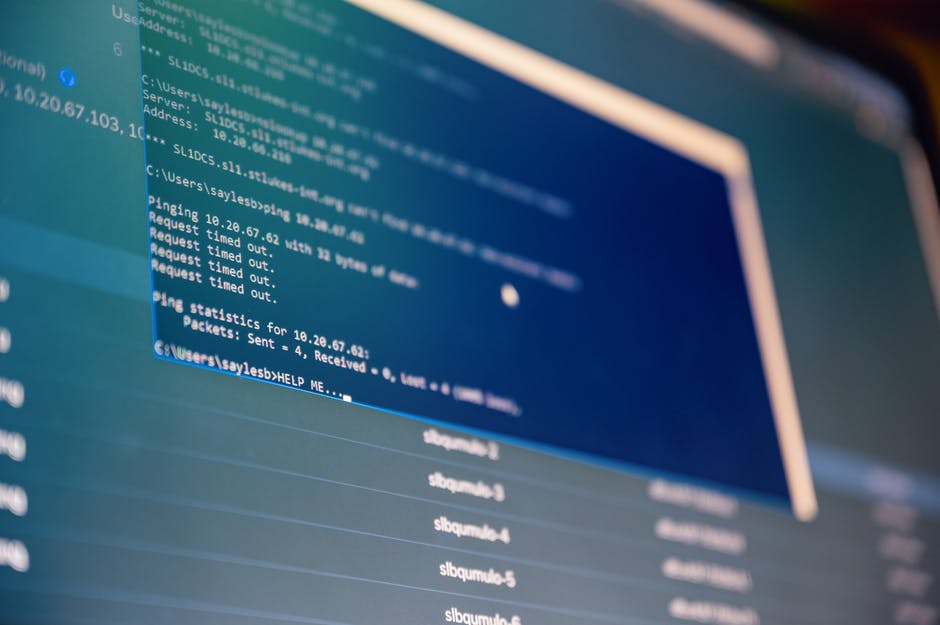

Transaction monitoring is a framework that monitors events in real-time and takes appropriate actions to monitor and control user actions. Each transaction security policy contains conditions that evaluate real-time events and actions fired after the conditions are met. Actions include blocking, multi-factor authentication, and notifications. Before you create policies, review the available event types, policy conditions, and practical usage. Extended transaction security is contained in real-time event monitoring.

Systems for Monitoring Transactions in the Payment System

It should be noted that over the past decade, international payment systems have taken and continue to take a wide range of innovative organizational and technical measures that allow in practice to increase the level of security of card transactions. The operation algorithms of the fraud monitoring system make it possible to evaluate a number of factors, the main ones being:

- The country from which the payment is made.

- The country of the bank that issued the card.

- Payment amount.

- The number of payments from the card.

- Payment history of a bank card.

- Profile of the average store payer.

When tracking suspicious activity, an anti-fraud system must continuously analyze huge amounts of data, events, and their context to detect anomalies in user behavior patterns. It is an approach that allows financial institutions to respond to threat risk in real-time and prevent fraudulent attacks. Continuous fraud monitoring looks at and analyzes data related to online and mobile banking sessions, devices, IP addresses, behavior, and all the events that users make – as they occur – to determine the level of risk.

The monitoring tool defines the following methods and means of protecting the payment system from fraud and reducing risks: legal aspects, the interaction of participants, training, analytical work, investigations, reporting, monitoring, products, and services. In the sense of ensuring the protection of the payment system from fraud, we should talk about instrumental complexity and consider MTS as one of the tools used. Obviously, with the growth of the card business, the risks of losses from the activities of criminals also increase, at least in absolute terms.